Martin Roberts is one of the UK’s most respected Property, Travel and Lifestyle TV presenters and journalists.

Celebrity Help! My House Is Haunted

One of the oldest Farmhouses in the Rhonda Valley, Martin Robert’s Tynewydd Farm recently featured on ‘Celebrity Help my House is haunted’ on the Discovery Channel. The film team commented that they had “rarely encountered such warm and friendly atmosphere“, and all those who visit noticed a peace and warmth that is hard to explain. We leave it to those who visit to make their own judgment, but can neither guarantee a meeting with our long-standing houseguests, nor be responsible in any way if you do. All we ask is that you are respectful of the house and those from down the centuries, to whom some believe it is still home.

You can visit Cottages With Character to view other beautiful cottages available from Martin Roberts.

Celebrity Help! My House Is Haunted

One of the oldest Farmhouses in the Rhonda Valley, Martin Robert’s Tynewydd Farm recently featured on ‘Celebrity Help my House is haunted’ on the Discovery Channel. The film team commented that they had “rarely encountered such warm and friendly atmosphere“, and all those who visit noticed a peace and warmth that is hard to explain. We leave it to those who visit to make their own judgment, but can neither guarantee a meeting with our long-standing houseguests, nor be responsible in any way if you do. All we ask is that you are respectful of the house and those from down the centuries, to whom some believe it is still home.

You can visit Cottages With Character to view other beautiful cottages available from Martin Roberts.

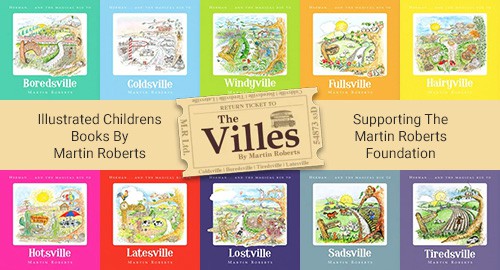

The Martin Roberts Foundation

As a father, children’s book writer and passionate campaigner for child wellbeing, Martin has set up a UK registered charity, called ‘The Martin Roberts Foundation’ to support educational and well-being initiatives for children. The charity’s first campaign is to raise enough money through sponsorship and donations to enable a copy of Martin’s book, ‘Sadsville’ to be distributed FREE to every school year 4 child (age 8/9) throughout the country. The book not only promotes problem solving in children, but also highlights Childline and serves as a directory for other charities and organisations that can help young people.

Presenter Showreel

A selection of clips from shows that Martin Roberts has either hosted or appeared in, including; I’m A Celebrity … Get Me Outta Here!, Homes Under The Hammer, Celebrity Masterchef, Pointless, The Chase.

Event Hosting Showreel

A selection of clips from shows that Martin Roberts giving examples of Martin presenting during awards ceremonies, hosting events, being an expert panellist and after dinner speaking